pay utah state property taxes online

Taxpayers paying online receive immediate confirmation of the payments made. Please note that for security reasons Taxpayer Access Point is not available in most countries outside the United States.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Online REAL Estate Property Tax Payment System.

. These are the payment deadlines. Confirmation acknowledges receipt of your information and intent to pay property taxes. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov.

You may also pay with an electronic funds transfer by ACH credit. If you do not have these please request a duplicate tax notice here. See also Payment Agreement Request.

This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file. CreditDebit Card or Checking Account Not a Deposit Slip. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

You may pay your tax online with your credit card or with an electronic check ACH debit. Salt Lake County hopes that you find paying your property taxes online a quick and simple process. You may also mail your check or money order payable to the Utah State Tax Commission with your return.

What You Need To Pay Online. You will pay the remaining balance or have the option to authorize SLCo to make the final withdrawal for. Follow the instructions at taputahgov.

Online payments may include a service fee. Paid online or by phone with a receipt transaction time before midnight Mountain Standard Time on November 30th. To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824.

Form of Payment Payment Types Accepted Online. You will need your property serial numbers. Property taxes can be paid online by credit card.

This web site allows you to pay your Utah County real property taxes online using credit cards debit cards or electronic checks. Weber County property taxes must be brought in to our office by 5 pm. File electronically using Taxpayer Access Point at taputahgov.

Please contact your financial institution to verify that funds have been transferred. Pay Manufactured Home Tax. Filing Paying Your Taxes.

Before continuing please make sure that you have the following information readily available. Nine electronic bank account withdrawals can be set up using this calculation 2021 taxesby 9 months 9 monthly payments. Be Postmarked on or before November 30 2021 by the United States Postal Service or 3.

Pay Real Property Tax. This web site allows you to pay your Utah County Personal Property Taxes online using credit cards debit cards or electronic checks. You can pay online with an eCheck or credit card through Taxpayer Access Point TAP.

The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers. Salt Lake County Property Tax Notice.

Step 1 - Online Property Tax Payments. What You Need. On November 30 or 2.

Rememberyou can file early then pay any amount you owe by this years due date. You can also pay online and avoid the hassles of mailing in a check. Pay Business Personal Property Tax.

Your Personal Property Account Number 2. Online PERSONAL Property Tax Payment System. This web site allows you to pay your Utah County real and business personal property taxes online using credit cards debit cards or electronic checks.

Utah Property Taxes Utah State Tax Commission

Utah State Tax Commission Official Website

Utah State Tax Commission Official Website

Utah Sales Tax Small Business Guide Truic

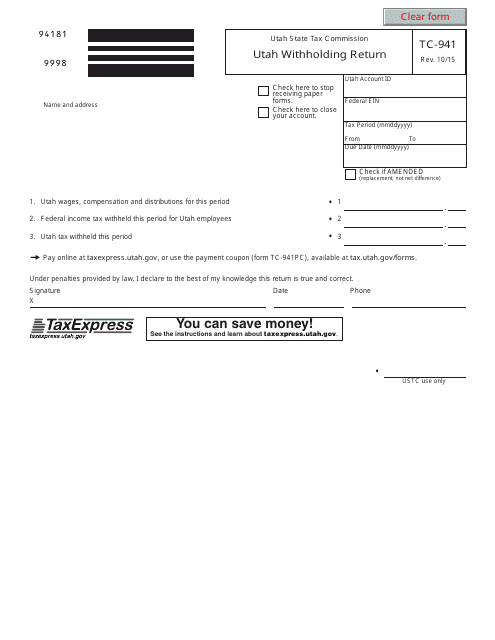

Form Tc 941 Download Fillable Pdf Or Fill Online Utah Withholding Return Utah Templateroller

Utah State Tax Software Preparation And E File On Freetaxusa

New Jersey Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax